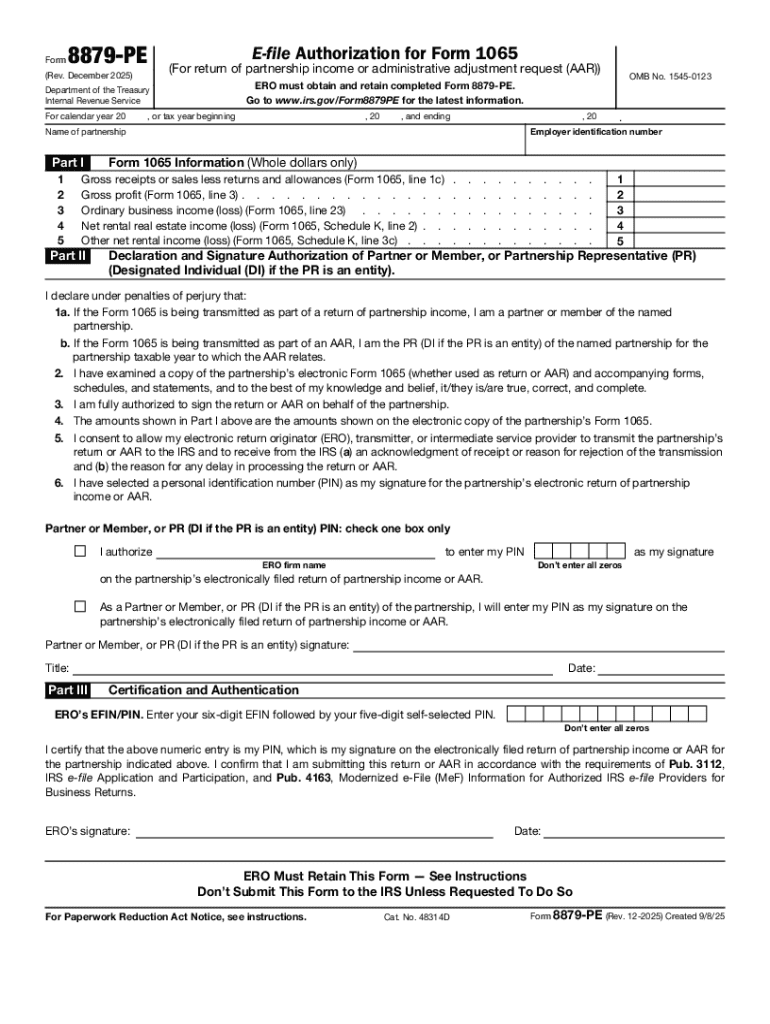

IRS 8879-PE 2025-2026 free printable template

Instructions and Help about IRS 8879-PE

How to edit IRS 8879-PE

How to fill out IRS 8879-PE

Latest updates to IRS 8879-PE

All You Need to Know About IRS 8879-PE

What is IRS 8879-PE?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8879-PE

What should I do if I made a mistake on my IRS 8879-PE after I filed?

If you realize you made a mistake on your IRS 8879-PE after submission, you can submit an amended or corrected return. Make sure to prepare the necessary documentation to support the corrections. It is important to notify the IRS as soon as possible to avoid any potential issues, and ensure your amended submission includes clear details regarding the changes made.

How can I check the status of my IRS 8879-PE submission?

To verify the status of your IRS 8879-PE submission, you can use the IRS ‘Where's My Refund?’ tool if you e-filed. Additionally, monitor your email for any automated notifications from the IRS regarding acceptance or rejection of your submission. If you encounter common e-file rejection codes, refer to the IRS guidelines for specific troubleshooting steps.

What are the privacy and security measures for the data provided on the IRS 8879-PE?

When submitting your IRS 8879-PE, the IRS employs strict data security measures to protect sensitive information. It is crucial to retain copies of your submitted documents securely. Be aware of phishing scams and ensure that you only provide your information through secure and official channels to maintain your privacy and data security.

What should I do if my e-filed IRS 8879-PE is rejected?

If your e-filed IRS 8879-PE is rejected, you will receive a notice detailing the specific reason for the rejection. Review the errors highlighted, correct them accordingly, and resubmit your form. In some cases, it may be necessary to consult with a professional to ensure that all corrections align with IRS requirements.

Can authorized representatives or power of attorney file the IRS 8879-PE on my behalf?

Yes, authorized representatives or individuals with power of attorney can file the IRS 8879-PE on your behalf. It is important for these representatives to have all necessary documentation, and they must adhere to the same guidelines and requirements as individual filers. Ensure that all submitted information is accurate and complete to avoid complications.

See what our users say